san mateo county tax collector property tax

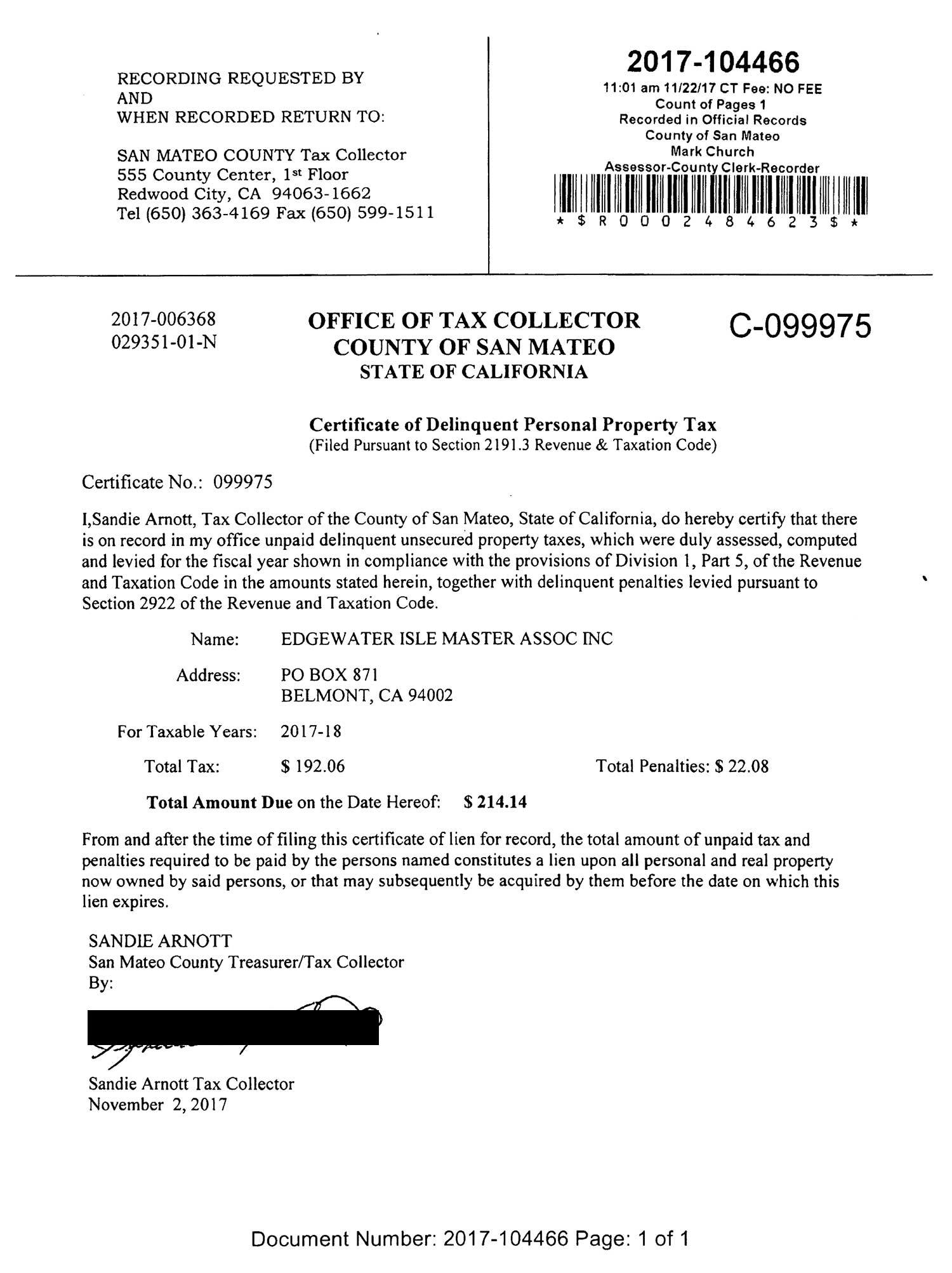

Home Controllers Office Property Tax The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately. Home Tax Collector Unsecured Property Taxes The following are questions we often receive from San Mateo County unsecured property owners.

Meet The Candidates In San Mateo County Who Are On Your Ballot

DocuSign to complete and submit with e-signature.

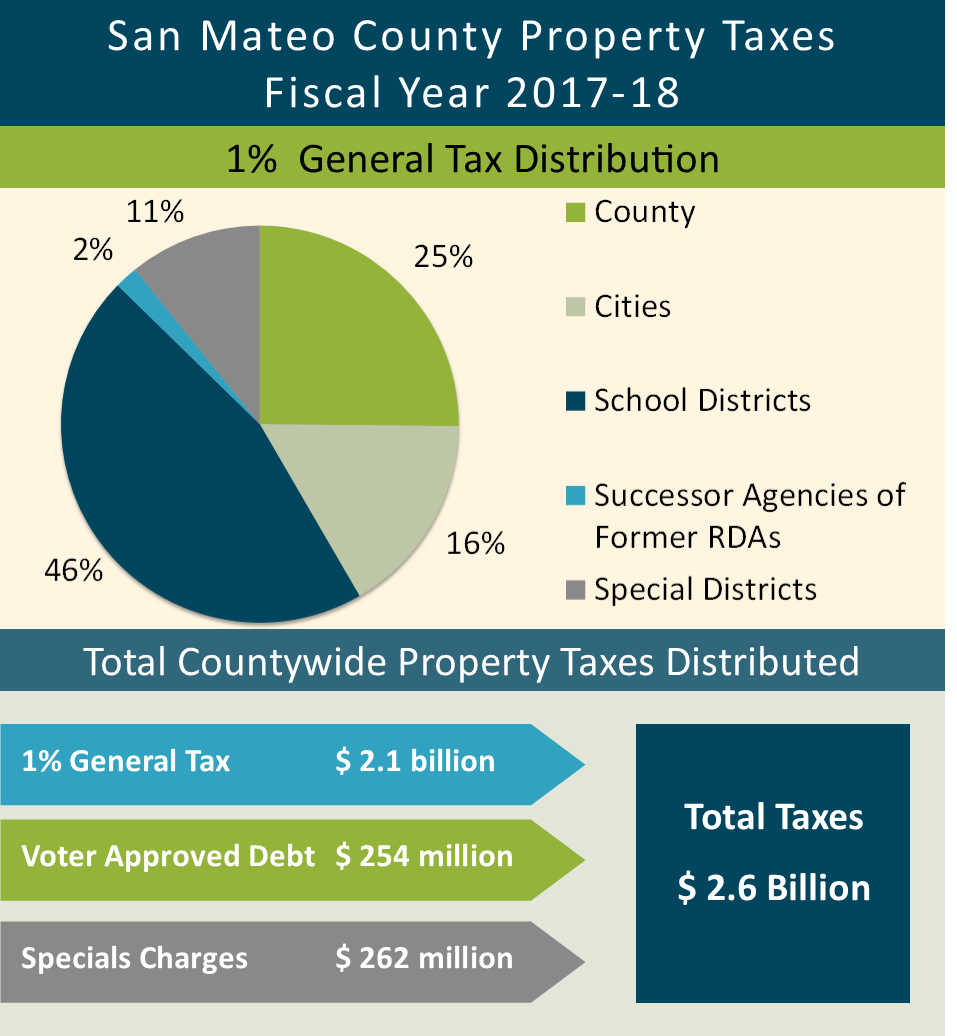

. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. Nature of Question Tax Rates. For specific information please call us at.

Please fill out the applicable forms below. Appeals on supplemental assessments must be filed within 60 days of the mailing date on the. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

Please be sure that you have funds available in your account to satisfy both checks. Enter the validation code that will be sent to your email. 2019 2022 Grant Street Group.

A summary of the property tax process in San Mateo County. Site Info Whois Traceroute RBL Check. If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which reduces your property tax.

Open San Mateo County. San Mateo County TreasurerTax Collector Sandie Arnott an elected official is charged with managing and protecting the Countys financial assets. Property Tax Bills and Refunds San.

Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less. You also may pay your. Typically property tax is 1 of the assessed value plus an amount to amortize voter-approved bonds and any fees for special assessments or charges such as mosquito abatement or sewer.

Nature of Question Tax Payments. The funds are invested in a portfolio of credit instruments called a pool. Announcements footer toggle 2019 2022 Grant Street Group.

The Property Tax Highlights publication includes information on the following. Lee Buffington Tax Collector-Treasurer-Revenue Services San Mateo County Redwood City Web Site Information. She acts as the banker for the County and directs the investment of the Countys funds.

For specific information please call us at 866 220-0308. The amount of taxes due for the current year can be found on the TreasurerTax Collectors web site or contact the Tax Collectors Office at 8662200308. If either check is returned for any reason the entire payment will be reversed and you will be assessed.

Generally property is assessed at the lesser of two values. Click on the form you want to submit. The median property tax also known as real estate tax in San Mateo County is 442400 per year based on a median home value of.

Appeals on annual assessments must be filed between July 2 and November 30. However they are still required to. Financial information for the fiscal year Historical.

The law provides property tax relief to property owners if the value of their property falls below its assessed value. San Mateo County collects on average 056 of a propertys assessed fair market value as property tax. Home Tax Collector Secured Property Taxes The following are questions we often receive from San Mateo County property owners.

San Mateo County California. San Mateo County has one of the highest median property taxes in the United States and is ranked 45th of the 3143. You can submit forms using.

You will be prompted to enter your name and a valid email address.

San Mateo Property Tax Deadline 5 4 Accepting Cash In Hmb Also Online Coastside Buzz

Property Taxes Due Monday In San Mateo County Sf Deadline In Flux

Alameda County Tax Collector Announces Property Tax Penalty Waiver Procedure News Pleasantonweekly Com

Fill Free Fillable Dtt Affidavit County Of San Mateo Transfer Tax San Mateo County Law Library Pdf Form

County Of San Mateo Government Quick Tip Tuesday Some Santa Clara County Taxpayers Reported Receiving Bogus Letters Like The One Pictured In This Post From A Non Existent Tax Lien Office

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

San Mateo County Issues Liens Against Master Association

Record Number Bail On Property Taxes East Bay Times

Why Property Taxes Are Still Due In San Diego County On Friday Cbs8 Com

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Property Tax Deadlines Andy Real Estate

Smc Home County Of San Mateo Ca

Early Property Tax Payments Homeowners May Benefit Lamorinda Ca Patch

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

Sandie Arnott County Of San Mateo Ca

San Mateo County Ca Goes Live With Taxsys Business Wire

Coronavirus Doesn T Delay Property Taxes In California Nbc Bay Area

We Kare Bay Area Reminder To Pay Those Property Tax Bills The Deadline To Avoid Penalties Is This Thursday 12 10 In Office Or Postmarked Avoid The 10 Penalty Payment Is Required